Insights

Assessing the Performance of Dutch Mortgages and European Asset Classes in 2022

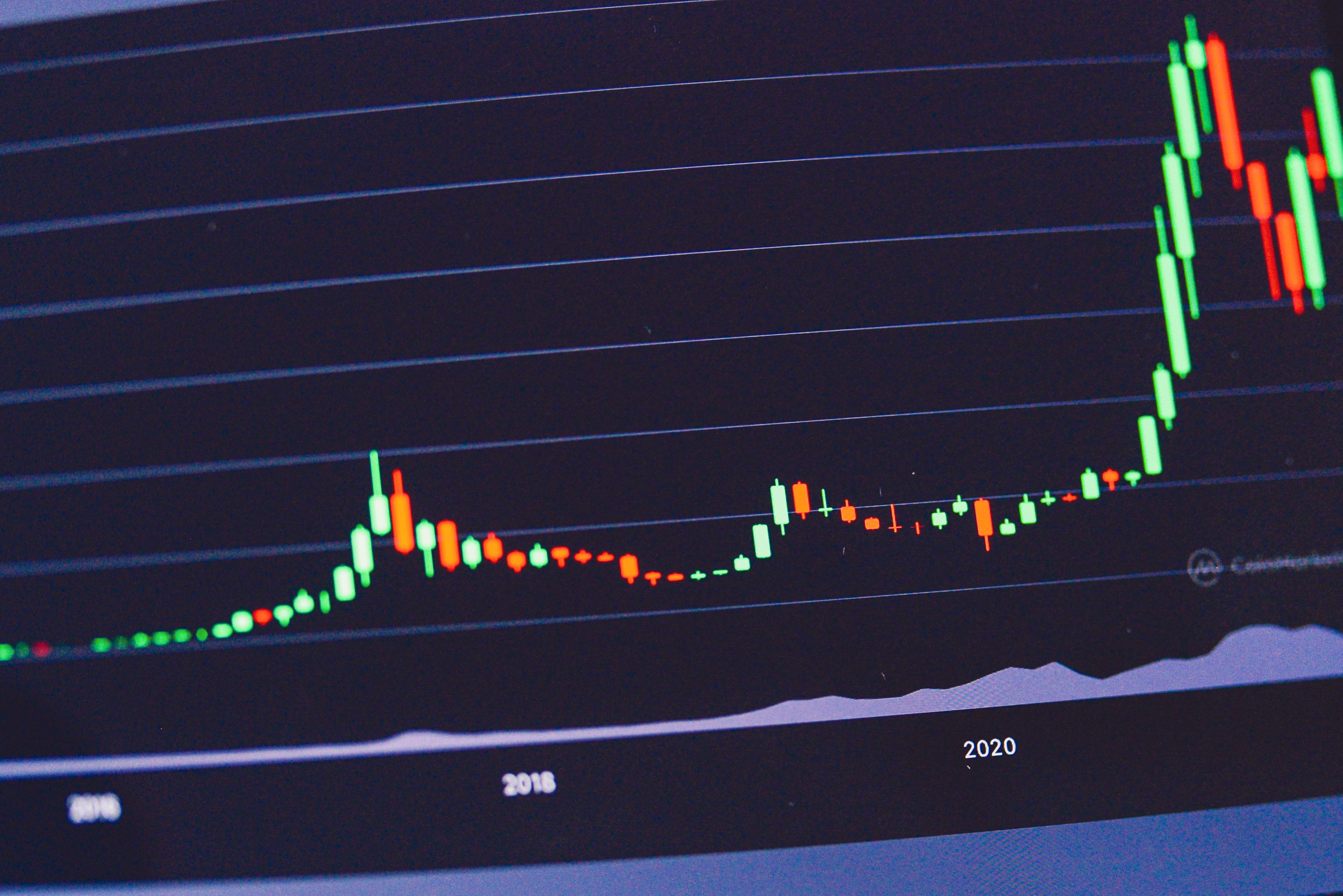

2022 has been a highly unusual year for investors. The war in Ukraine followed by distorted food and energy supply chains resulted in high inflation and some of the fastest rate hikes in history. These events resulted in decreasing asset prices across all markets and one of the worst years in history for a 60/40 portfolio. Previously, we compared the performance of Dutch mortgages, using the LoanClear Dutch Mortgage Index, to other European asset classes up to the first half of 2022 [1]. The LoanClear Dutch Mortgage Index provides insights in the performance of Dutch mortgages.

Private credit rates vs liquid market rates

Dutch Mortgages in a Multi-Asset Portfolio

Comparing Inflation in the USA and Eurozone: putting things in perspective

Dutch mortgage rates - Market developments

Making the Dutch housing stock more sustainable

US Consumer Credit Outlook: Focus on Low-Income Borrowers

Dutch housing has never been as unaffordable for starters as it is today

Geopolitical Risks: Implications for US Consumer & SME Credit

Increased energy prices: Implications for Dutch mortgage borrowers

Dutch mortgage valuation index – 2021-Q3 Update

How automatic risk class adjustment affects investor returns and portfolio valuations

Asset performance during periods of high inflation

Increased risk-taking by youngest mortgage borrowers

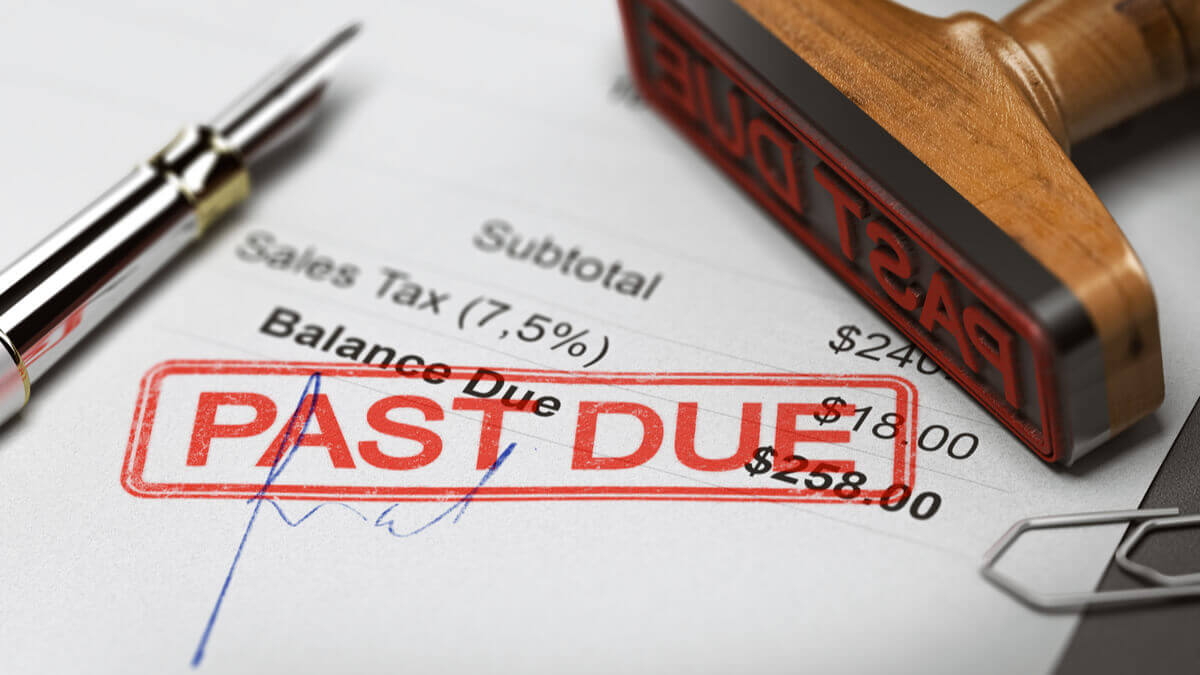

Payment Holidays in the EU: Implications for Asset Quality

Search for drivers of Dutch Mortgage Arrears

Impact of increased transfer tax on BTL investments and the rental market

Loan Support Schemes and SME Sentiment in the UK

Dutch mortgage arrears back to pre-pandemic level

First signs of COVID-19 impact, Dutch mortgage arrears are rising

Asset performance during the COVID-19 pandemic - issue 3 EU SME Support Programmes

Snapshot of asset performance during the COVID-19 pandemic - issue 2 - EU ABS/CLO